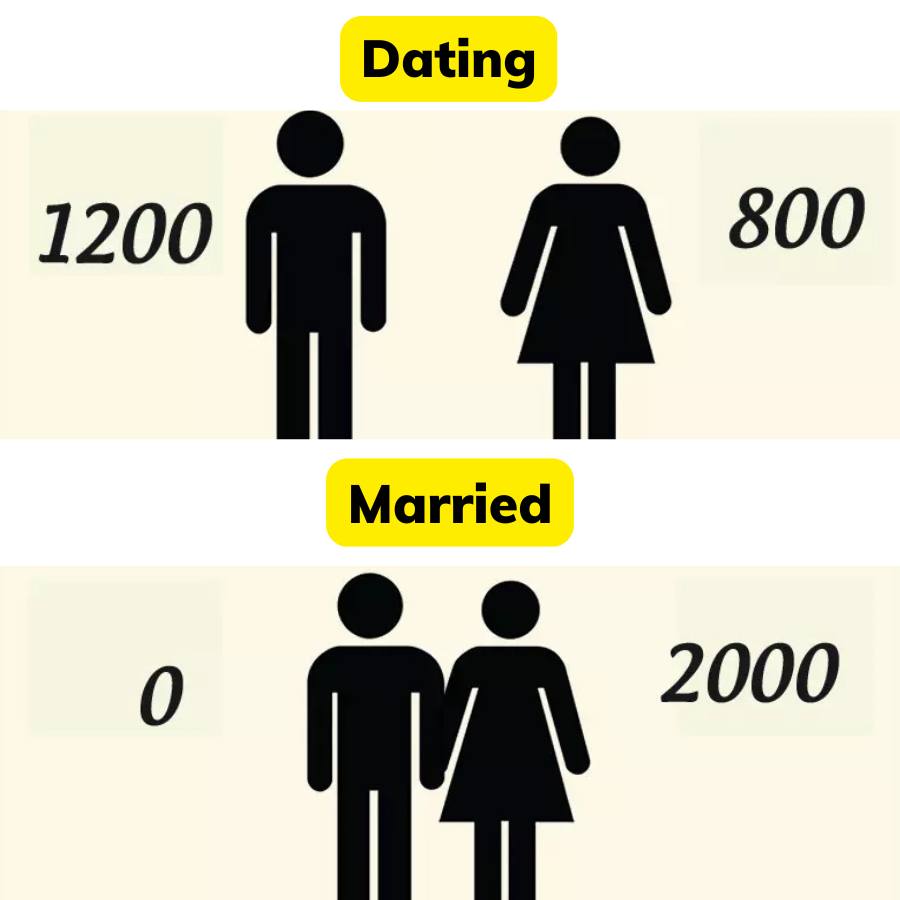

Let’s face it—money dynamics change drastically once a relationship transitions from casual dating to marriage. What used to be lighthearted conversations about splitting dinner bills can suddenly turn into serious discussions about joint bank accounts and mortgage payments. But let’s break it down with a humorous twist: dating money rules vs. marriage money rules.

When You’re Dating: Your Money, My Money

In the dating phase, financial independence is key. Each person manages their own money, and there’s an unspoken rule that goes something like this:

- “You pay for your stuff, I’ll pay for mine. We’ll split dinner… or maybe I’ll treat you tonight, and you’ll get the next one.”

It’s all about fairness and balance. There’s no pressure, and no one’s keeping tabs—well, maybe a little tab. The point is, financial boundaries are clear, and personal budgets stay intact.

Gifts are thoughtful but carefully considered. No one’s out here draining their savings for a designer bag or a fancy vacation unless it’s a big milestone.

When You’re Married: Our Money (But Mostly Mine)

Fast forward to marriage, and things shift significantly. Suddenly, it’s not your money and my money—it’s our money.

Well, sort of.

- Your salary? That’s our money.

- My salary? That’s… well… still my money.

It’s like some kind of financial magic trick where two incomes become one shared pool… but only one person seems to have easy access to it.

Spending also changes. When you’re married:

- Your impulse Amazon purchase? “Honey, we needed this!”

- Their impulse Amazon purchase? “Do we really need another gadget?”

Joint accounts become common, budgets intertwine, and financial secrets are harder to keep. There’s a new level of financial transparency, and sometimes, a new level of financial tension.

Why the Change Happens

This shift isn’t about greed or control—it’s about trust, security, and the understanding that marriage often involves shared goals:

- Buying a house

- Planning vacations

- Raising kids

- Saving for retirement

When two lives merge, so do their finances. But let’s be honest—it’s also because one person is usually a saver and the other is a spender.

A Universal Joke, But a Real Conversation

This classic joke about money dynamics in relationships exists because it holds a little truth. Relationships, especially marriages, require open communication about finances to avoid misunderstandings or resentment.

- Set financial goals together.

- Have regular “money talks.”

- Be clear about who manages what (and why).

And most importantly, keep a sense of humor about it all.

Final Thoughts: Love and Money—A Balancing Act

Whether you’re in the dating phase or happily married, financial conversations are part of the deal. The key is balance, honesty, and maybe a shared laugh every now and then about whose money is really whose.

So, the next time your partner says, “What’s mine is yours, and what’s yours is mine,” just smile… and maybe double-check the bank statements.

Because at the end of the day, whether it’s your money or our money, the best investment is in each other. 💍💸✨